In the ever-evolving world of cryptocurrency mining, where fortunes rise and fall like digital tides, the pricing of mining machine hosting services has become a focal point of intense scrutiny. As companies like ours specialize in selling and hosting mining machines, understanding these pricing trends is crucial for miners seeking to maximize their returns. Factors such as energy costs, market volatility, and technological advancements play pivotal roles in driving these fluctuations. For instance, the surge in Bitcoin’s popularity has often led to spikes in hosting fees, as demand for powerful rigs intensifies. Yet, amidst this chaos, opportunities emerge for savvy investors who navigate the waves with precision and foresight.

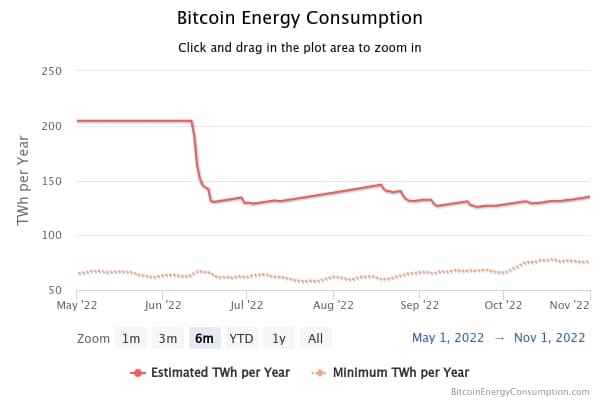

Delving deeper, energy consumption stands as one of the primary drivers behind the ups and downs in hosting service costs. Mining machines, particularly those designed for Bitcoin and Ethereum, devour electricity at alarming rates, turning data centers into voracious energy hogs. In regions where renewable energy sources are abundant, hosting prices might dip, offering a breath of fresh air to miners of altcoins like Dogecoin. Conversely, in areas plagued by rising utility bills or geopolitical tensions, costs skyrocket, forcing operators to pass on the burden. This delicate balance between sustainability and profitability underscores the broader ecosystem, where a single policy shift can ripple through the market like a shockwave.

Market demand for cryptocurrencies such as Bitcoin, Ethereum, and even the whimsical Dogecoin directly influences hosting pricing. When Bitcoin hits new all-time highs, as it often does, the rush to acquire and host mining rigs creates a frenzy that inflates service fees. Exchanges buzz with activity, traders speculate, and hosting providers capitalize on the boom. Yet, during bear markets, when Ethereum’s smart contract allure fades or Dogecoin memes lose steam, prices can plummet as providers compete fiercely for dwindling clients. This cyclical nature adds an element of unpredictability, making it essential for miners to stay attuned to exchange trends and global sentiment.

Technological innovations, too, weave into this complex tapestry. Advanced mining rigs, optimized for efficiency in processing blocks on networks like Ethereum’s proof-of-stake transition, can lower operational costs over time. Our company, for example, offers state-of-the-art miners that reduce heat output and energy waste, potentially driving down hosting prices in the long run. However, the initial investment in these cutting-edge machines often hikes up short-term fees, especially when integrated into large-scale mining farms.

This interplay between innovation and expense creates a rhythm of peaks and valleys, where early adopters reap rewards while laggards scramble to catch up.

Regulatory landscapes add another layer of complexity to pricing dynamics. Governments worldwide are tightening grips on crypto activities, with implications for mining farms and their hosting services. In some jurisdictions, favorable regulations encourage the growth of Dogecoin and other meme coins, leading to lower hosting costs as infrastructure expands. Elsewhere, stringent rules on energy usage or taxation can escalate prices, making Bitcoin mining less accessible. As exchanges adapt to these changes, miners must weigh the risks, ensuring their strategies align with both legal frameworks and market realities.

Looking ahead, the future of mining machine hosting pricing hinges on a blend of global events and internal efficiencies. If renewable energy adoption accelerates, we might witness a downward trend, benefiting enthusiasts of Ethereum and its eco-friendly upgrades. On the flip side, if supply chain disruptions for mining rigs persist, costs could climb once more. At our company, we’re committed to transparency and innovation, helping clients navigate these trends whether they’re diving into Bitcoin’s depths or exploring Dogecoin’s lighter waters. Ultimately, staying informed and adaptable will be the key to thriving in this vibrant, unpredictable arena.

In the volatile crypto realm, this piece unveils how energy spikes, market frenzies, and tech leaps twist mining hosting prices—costs soar on scarcity waves but plummet with innovations, keeping investors on edge.